ANNUAL ECONOMIC REPORT No.10

MARCH 2024

Dear

reader, Executive Summary

CONSTRUCTION INDUSTRY

Welcome to the CECE Annual Economic Report!

A year of two halves – this is what 2023 was all about!

Indeed, in terms of economic performance, 2023 was divided into two different semesters with diverging trends: substantial stability in the first half and visible decline from the summer till the end of the year. What materialised at the end cannot be defined as a soft landing, but it was certainly not alarming, most of all coming from very high absolute numbers of end-2022.

The report you are reading contains an in-depth analysis of the macroeconomic situation in Europe, insights into your major client sectors and a substantial focus on the sales performances of machinery and equipment.

The snapshot of this year’s report features another important client sector in Europe. On page 12 you will read an interview with the Secretary General of ELCA, the European landscape contractors association.

The business sentiment that we gauge monthly through the CECE Business Barometer has moved into negative territory during 2023 and the trend is definitely pessimistic. Order books are close to empty, employment plans confirm the industrial challenges for our member companies and sales projections are negative for 2024.

It is now difficult to make a numerical forecast for 2024, but the Equipment Market chapter in this report will provide some relevant market intelligence for companies and investors to ponder. Please share this report within your network without moderation! Indeed, as a publicly available source of information, the CECE Annual Economic Report helps to promote the knowledge and understanding of the sector amongst the wider audience. Comments are always welcome and can be directed to info@cece.eu. If you want to get an overview of the report before reading it, please take a look at this video We strive to provide CECE members and the public with all relevant information and intelligence, produced by our own team of economists. Indeed, this report is produced by a small group of experts from the CECE member associations and the CECE team in Brussels. Please read more about them on page 14. The report also includes information provided by our national member associations, shedding light on specific market developments.

I hope you will enjoy reading the report!

European construction activity remained resilient during 2023 despite the headwinds created by higher financing costs, input cost inflation and labour shortages. This resilience is expected to continue in 2024, although the outlook varies by country and sector.

MINING INDUSTRY

Exploration and drilling activity in the global mining market reached peak levels in 2022. Exploration budgets for the major global mining companies exceeded 2020 and 2021 levels, and reached the highest levels seen since 2013. However, in 2023 drilling activity has been on a downward trend and by the end of the year had reached the lowest levels since 2020.

Riccardo Viaggi CECE Secretary General

Riccardo Viaggi CECE Secretary General

EXTRA FEATURE: RENTAL INDUSTRY

The ERA/IRN Rental Tracker indicates the noticeable deterioration in business sentiment in Europe’s equipment rental industry from the middle of 2023 continued through to the end of the year, although it is a far from dramatic decline.

EQUIPMENT MARKET

2023 was a year of transition for the European construction equipment sector. Amid a severe downturn within the building construction industry and an increase in geopolitical crises, new order intake for equipment went down significantly. However, sales on the European market were still comparably stable – with notable differences across subsegments and regions. This was primarily due to the strong order backlog built up in 2021/2022, but which has now been exhausted.

OUTLOOK

It is encouraging that cancellation of orders is not significant within Europe. In addition, levels of inventory have increased, but are not at extraordinarily high levels. As machine delivery times are no longer an issue, the ordering behaviour of end-use customers has returned to a much more short-term pattern. This suggests that current low order volumes may only be temporary, and the situation should pick-up during the course of the year.

1 CECE ANNUAL ECONOMIC REPORT March 2024

A smooth landing is possible for the global economy in 2024-2025

Although natural gas and oil prices have eased and avoided the recessionary scenarios feared at the end of 2022, the Eurozone has still been affected by the consequences of the war in Ukraine.

Growth in the Eurozone of approximately 0.5% for 2023 has lagged significantly behind the momentum seen in the United States. While decision making by companies on investment and employment have remained positive, household consumption has slowed down significantly due to the surge in inflation.

European households choosing to maintain high savings rates has also been a factor in this. Exports saw a disappointing performance last year, mirrored by a drop in manufacturing output of 6.9% during the year. With the rise in energy prices and ongoing uncertainty about their future direction, the Eurozone has experi -

enced a significant deterioration in price competitiveness. This is evident when comparisons are made with the United States and, more importantly, with Asian economies that have seen both a combination of no inflationary increases and a depreciation in currencies. At a global level, with stable growth and no inflationary pressure, the likelihood of a sharp downturn has faded, with the factors influencing growth being generally balanced.

However, between China, the United States, and the Eurozone, significant divergences have emerged both in terms of inflation and economic growth. As a result, the ability of Europe to join the investment activity being led by the United States and China is a matter of concern.

According to the IMF, the euro area is expected to grow by 0.9% in 2024, down from 3.3% in 2022 and 0.5% growth last year. Contrary to many economies, the

euro area hasn’t experienced stronger than expected economic growth. The notably subdued growth in the euro area reflects weak consumer sentiment, the lingering effects of high energy prices, and weakness in manufacturing and business investment, which are sensitive to interest rate levels.

When faced with the same issues, American and European consumers have made different decisions. In terms of investment levels, the United States embarked on significant increases in industrial rearmament, while China reallocated bank credits away from real estate towards industrial development. In contrast, Europe is lagging behind, with diminishing investment levels, and differences being experienced between the financial situations for households and businesses.

2 CECE ANNUAL ECONOMIC REPORT March 2024

MACROECONOMIC VIEW

Sources: IMF (GDP), European Commission (Investment in equipment) - November 2023

2022 2023 2024 2025 2022 2023 2024 2025 Germany +1.8% -0.3% +0.5% +1.6% +4.0% +3.8% +2.7% +2.7% France +2.5% +0.8% +1.0% +1.7% +0.9% +5.7% +4.3% +1.6% UK +4.3% +0.5% +0.6% +1.6% +15.3% +11.1% +1.5% +1.4% Spain +5.8% +2.4% +1.5% +2.1% +1.9% +1.0% +5.3% +3.6% Italy +3.7% +0.7% +0.7% +1.1% +9.1% +4.5% +2.5% +4.9% EU +3.4% +0.5% +0.9% +1.7% +4.2% +4.0% +3.0% +2.9% Gross Domestic Product growth in % Gross Investment in equipment in %

The slowdown in the European construction industry will continue

European construction activity remained resilient during 2023 despite the headwinds created by higher financing costs, input cost inflation and labour shortages. This resilience is expected to continue in 2024, although the outlook varies by country and sector.

IN 2023, THE CONSTRUCTION INDUSTRY WAS AFFECTED BY THE WEAKNESS IN THE BUILDING SECTOR

After an unexpected but welcome period of growth in 2022, the construction sector in Europe has seen a less positive situation in 2023. The impact of rising interest rates and the war in Ukraine have held back the sector’s growth prospects. The decline in construction output in 2023 is estimated to have been around 1.7%. While civil engineering continued to expand in 2023, building construction declined.

The entire eurozone experienced declines across the key construction sectors, especially in house-building activity, with future indicators pointing towards further declines. With a few exceptions, all European countries are on a downward trend due to a range of factors. This includes the sharp rises in interest rates and construction product prices, and the persistence of high inflation resulting in reduced household purchasing power. Alongside this, there has been a slowdown in economic growth, tightening of public spending budgets and falls in real estate prices.

At current interest rate levels, returns on real estate investments are also a negative, which is also holding back growth. Added to this, there is ongoing uncertainty about the future of hybrid working practices and their negative im-

GDP and Construction Output in Europe Year to year change, % in real terms

pact on commercial real estate values. The construction sector in Germany experienced a challenging market in 2023, against the background of a wider economic slowdown. Higher product costs, labor market constraints, and a challenging financing environment impacted the market, particularly for housebuilding activity. The PMI index has been indicating a prolonged and deepening downturn since April 2022, with no clear end in sight at this stage.

In Italy, construction investment grew by 5% in 2023, with positive dynamics seen across all the sectors. Private non-residential construction (+5%) and public non-residential construction (+18%) showed significant increases, driven by the National Recovery and Resilience Plan and the closure of the 2014-2020 European structural funds programme. However, housebuilding investment only showed a modest increase of 0.7% compared with 2022.

In France, construction activity fell to its lowest level in three years in 2023, indicating a steep and accelerated decline. Italy experienced a sharp decline in activity, but funding from the Na-

tional Recovery and Resilience Plan helped to maintain a positive outlook.

In Spain, construction output grew by 3.5% in 2023, supported by investments in transport, renewable energy, housing, and industrial sectors. Alongside this there was financial support from the European Union’s Recovery and Resilience Facility. In the United Kingdom, construction activity is on a declining trend and output is forecast to fall by 2.1% in 2024. A significant part of this are reductions in private new housing and repair and maintenance activity. The rise in interest rates is a key contributor to this slowdown, making mortgages more expensive and reducing consumer spending power for home improvements. Alongside this there are some signs of improving business sentiment in some of the other sectors.

According to the latest Eurostat statistical report, construction output in November 2023 was 2.2% lower in the euro area, and 2.1% lower in the EU compared with November 2022. This was the steepest fall in output since February 2021, and had increased from a fall of 0.7% in the previous month. Making similar

3 CECE ANNUAL ECONOMIC REPORT March 2024

CONSTRUCTION INDUSTRY

-6.10% 6.10% 3.50% 0.50% 1.30% 1.60% 1.60% -4.50% 5.30% 2.70% -1.70% -2.10% 1.50% 1.60% -8% -6% -4% -2% 0% 2% 4% 6% 8% 2020 2021 2022 2023 2024 2025 2026

GDP Construction Output

comparisons for other sectors, building construction declined by 2.4% and civil engineering by 1.0% in the euro area in November 2023, compared with November 2022. In the EU, building construction output decreased by 2.5%, but civil engineering increased by 0.2%.

CONSTRUCTION ACTIVITY IS EXPECTED TO SHOW A SMALL GROWTH IN VALUE IN 2024, BUT A DECLINE IN

REAL TERMS

According to Euroconstruct, construction output is expected to be lower than expected in 2024, and a recovery is not anticipated until 2025. The European construction industry is forecast to show a 2.1% decline in 2024 followed by moderate growth of around 1.5% in both 2025 and 2026.

High interest rates and a weaker economy have deterred both home buyers and businesses from investing in new buildings. The European Central Bank’s aggressive monetary tightening has reduced demand for large projects, reflected in a decline in building permits for both residential and non-residential construction.

While declining interest rates may eventually stimulate new investment, a recovery in construction output is not expected until early 2025 due to limitations imposed by a reduction in building permits. Residential construction activity is experiencing a sharp downturn, with housing completions anticipated to hit the lowest level since 2016 by 2025.

In addition, consumer price inflation is expected to remain above historical levels in many countries in 2024, and only a minority expect to see a fall below the 2.5% mark. The slowdown in residential activity is most significant in Sweden, Italy, Finland, and Hungary.

However, alongside this, in larger residential markets like the UK, Germany, and France, there are also significant reductions in output.

In 2024, prospects are poor for new non-residential building activity and

output is expected to decline. Following this, a revival is expected to see a return to growth in output. Following strong growth in 2022, the repair and maintenance sector has started to decline and this is largely attributed to the slowdown in the residential sector.

Overall, renovation activity in Europe is expected to decline in 2024, driven by the residential sector. Civil engineering is expected to be more resilient than the building sectors and is unlikely to see any decline in activity before 2025.

Growth in this sector is due to the need to develop transport networks and increase energy production and distribution. The long-term outlook for the civil engineering sector remains positive, as these are projects that will take years to complete.

The outlook for the construction industry in Europe shows significant variations across the countries. In Spain, growth in output is anticipated to have been 3.5% in 2023 and is forecast to be followed by average annual growth of 2.6% from 2024 to 2027.

In contrast, the Italian economy is currently in a fragile growth phase with uncertain expectations. Leading research institutes have expressed caution about Italy’s growth in 2024.

Output in the construction sector is expected to decline by 7.4%, due main-

ly to a 27% decline in the expansive contribution of extraordinary maintenance. Construction activity in Germany is expected to shrink by 3.5% in 2024, but will show a modest recovery in 2025 with output growing by 0.5%.

The French construction industry saw a downturn in 2023, but some stabilization is expected in 2024.

From 2025, a resurgence is anticipated, driven by government investment in renewable energy and the industrial infrastructure to achieve France’s carbon neutrality goals by 2050. In the UK, after a 2.1% fall in 2024, construction output is expected to rise by 2.0% in 2025, based on the expectation of lower interest rates.

There have been some limited signs of a short term recovery in the European construction sector. Construction companies have also seen an indication of better prospects with the EU construction confidence indicator improving slightly in the last three months of 2023 – even though it still remains negative. Companies involved in repair and maintenance activity are likely to be more optimistic about prospects within the industry.

The renovation subsector (including sustainability work) should see a structural growth in demand in 2024 and EU contractors order books are still wellfilled with almost nine months of work.

4 CECE ANNUAL ECONOMIC REPORT March 2024

75 90 105 120 1 4 7 10 1 4 7 10 1 4 7 10 1 4 7 10 1 4 7 10 1 4 7 10 1 4 7 10 1 4 7 10 1 4 7 10 2015 2016 2017 2018 2019 2020 2021 2022 2023

series Euro area UE

Production in the construction sector 2015=100, seasonally adjusted

Shipments of surface mining equipment were on a downward trend in the second half of 2023

Exploration and drilling activity in the global mining market reached peak levels in 2022. Exploration budgets for the major global mining companies exceeded 2020 and 2021 levels, and reached the highest levels seen since 2013. However, in 2023 drilling activity has been on a downward trend and by the end of the year had reached the lowest levels since 2020.

The Parker Bay Company monitors deliveries of surface mining equipment to the global mining market on a quarterly basis. Their latest update for Q4 2023 is shown in the graph below and indicates that shipments were on a downward trend in the second half of 2023, with shipments in Q4 declining by 20% in volume terms compared with Q3.

However, due to a strong first half year, shipments overall in 2023 in volume terms still showed a 1.4% increase on 2022 levels. In value terms, the increase was more significant at 6.5% compared with 2022, reflecting the delivery of more higher value equipment.

The pattern of shipments at the end of 2023 was different across geographical regions and equipment types. Not surprisingly, shipments to Russia/CIS were on a downward trend in 2023 compared with earlier years. Shipments in Q4 were less than half the levels seen in Q3. North America was the only region that saw shipments increase in Q4, at 16% above Q3 levels. Other regions were on a downward trend at the end of last year, and while not as significant as Russia / CIS, Australasia saw a 22% fall and Latin America a 21% decline on shipments in Q4 compared with Q3.

All the product lines saw a decline in shipments in Q4 compared with Q3. Wheeled loaders were the best performing equipment type with only a 7% fall in Q4. The most popular equipment type, Mining trucks saw a 16% decline in shipments, but hydraulic excavators/shovels saw a 25% decline and dozers saw a 25% fall in Q4.

Parker Bay operate a mining equipment database which includes eight different types of surface mining equipment. Their latest assessment of the machine population suggests that it has grown during the last year to indicate that just under

95,000 pieces of equipment are active in the global mining market.

This compares with 89,000 machines at the end of 2022. Mining trucks are estimated to account for over 60% of the machine population with just under 59,000 in use at the end of 2023.

Three equipment types account for over 85% of the total machine population and include dozers (over 16,000 machines), hydraulic shovels/excavators (over 6,000 machines).

5 CECE ANNUAL ECONOMIC REPORT March 2024

GLOBAL MINING INDUSTRY

Lower confidence, but no collapse

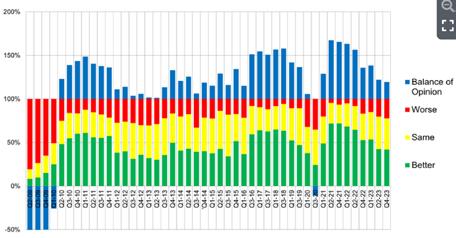

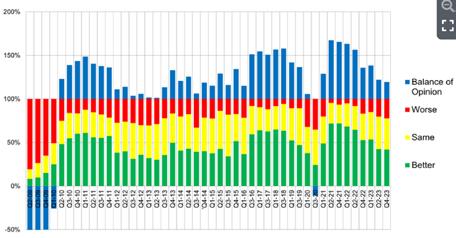

More than 125 companies responded to the ERA/IRN RentalTracker survey for the final quarter of 2023.

The noticeable deterioration in business sentiment in Europe’s equipment rental industry from the middle of 2023 continued through to the end of the year, although it is a far from dramatic decline.

In the Q4 ERA/IRN RentalTracker survey, undertaken at the end of December and start of January, almost a third of companies reported a deteriorating situation, with more than 40% seeing no change and 27% reporting improving conditions. That led to a negative balance of opinion of -5% (the difference between the proportions reporting positive and negative views), which is almost identical to the results of the Q2 survey at the end of June 2023.

We have to go back to the start of the pandemic in 2020 to find another period of negative opinion on ‘current conditions’. This relatively low level of confidence should not be surprising, given that the survey took place at a time of higher interest rates and near or actual recession in the Eurozone and the UK.

However, the worsening conditions are not yet having a powerful impact on business volumes. There is still a large +20% positive balance of opinion on business levels in the final quarter of 2023 compared to the same period in 2022.

That means 42% were reporting an improved quarter compared to a year ago against the 22% reporting a worse quarter. Although still positive, that is lower than all the surveys since the end of the pandemic and shows a slowing up of year-on-year growth trend since the end of 2020.

That context, of a slowing up of growth rather than a dramatic reversal, is supported by the results of the ‘full year’ levels of activity for 2023

Europe: business conditions now (end Dec, 2023)

against 2022. Here, 57% reported higher levels of activity, with 26% reporting no big change, and just 17% reporting a decline in activity for the full year. That resulted in a pretty remarkable +40% balance of opinion on overall 2023 activity levels.

KEY RENTAL METRICS

What about the key business metrics of utilisation, fleet capital investment, and employment intentions?

lisation

the downward trend which started in the Q4 survey in 2022 continued, although there remains a very small positive balance opinion, just +4%. More than 30% of companies reported improving fleet utilisation against 27% who said it was worsening. Some 43% said it was steady.

That means almost three quarters of respondents says utilisation was either steady or increasing, so a positive finding given the wider economic conditions.

Europe: current quarter versus last year

6 CECE ANNUAL ECONOMIC REPORT March 2024

-

XTRA F RENTAL MARKET

Europe: time utilisation trend

You might expect that rental companies would soften their fleet investment plans in the face of slow economic growth, and that is indeed what we find, and it is a significant shift, with a negative balance of opinion of -15% (equating to 17% expecting to increase spending and 32% expecting a decrease). More than 50% said investment would be the same as 2023.

Remarkably, that’s the first time in 10 years that there has been a negative balance of opinion on this ‘next year CapEx’ question. (For readers wondering about the pandemic period: when the crisis hit, companies were expecting higher levels of spending in the following year, when they anticipated that the crisis would be over.)

DEMAND FOR EMPLOYEES

The employment question continues to be something of an exception to the broadly deteriorating trends, with many companies still trying hard to recruit staff. At the end of December, 92% of companies were either planning to maintain or increase their staffing levels and just 9% were expecting to reduce their workforces.

That meant a positive balance of opinion in favour of recruitment of +28%, which is high. Even here, though, there is evidence that sentiment is shifting down, with that figure being the lowest since the third quarter of 2020, during the pandemic. This positive balance has been steadily decreasing since hitting a high of more than +60% at the beginning or 2022.

When asked about their expectations a year ahead, there was no worsening in sentiment compared to the previous survey in June 2023, and there was actually a

small increase in the positive balance of opinion to +22.5% (it was +19% in Q2 2023).

That is still rather low, historically speaking, but remains a positive finding. It might reflect a generally upbeat view among rental companies about the potential for rental to grow as an industry, but is also likely a reflection of the shallow nature of the current recession (or near recession), which could imply a relatively quick recovery next year.

Germany was top of the league in terms of expectations a year from now – possibly reflecting the view that ‘things must get better’ – but bottom in terms of CapEx expectations in 2024 and one of the lowest in sentiment on current market conditions at the end of Q4 last year.

Multinational companies were generally more positive than their national or regional competitors, and were, for example, the most likely to be increasing fleet investment in 2024. That will no doubt please the OEMs.

The number of responses from countries like the UK, Italy and France do not justify definitive judgements, but in all three cases business sentiment was not high among those who did respond. In most of the metrics, the three countries were in the lower half of the league table. Notably, they were the least optimistic that things would be better 12 months ahead, in all cases fewer than 30% of respondents expected an improvement by January 2025.

So, the Q4 ERA/IRN RentalTracker manages to reflect quite well a particular moment in Europe’s rental market: slower

Europe: fleet investment next year

COUNTRIES AND REGIONS

This survey we had a particularly strong response from companies in Spain and Germany. In the case of Spain, there was a much greater degree of positivity than elsewhere: the country was top of the league in five measures: expectations for 12 months ahead, current market conditions, Q4 growth year-on-year, utilisation trends and employment intentions. In that sense it is an ‘outlier’ in this survey.

general economic conditions, deteriorating conditions in rental at the end of last year, and a softening of fleet investment plans for this year, but simultaneously with activity levels holding up rather well.

We will see in the Q1 2024 survey at the end of March if they continue to hold up.

7 CECE ANNUAL ECONOMIC REPORT March 2024

Source: KHL, European Rental Association ERA. Rental Tracker is jointly organised by International Rental News (IRN) and ERA.

2023, a year of transition for the European construction equipment industry

2023 was a year of transition for the European construction equipment sector. Amid a severe downturn within the building construction industry and an increase in geopolitical crises, new order intake for equipment went down significantly. However, sales on the European market were still comparably stable – with notable differences across sub-segments and regions. This was primarily due to the strong order backlog built up in 2021/2022, but which has now been exhausted.

Sales of equipment in Europe declined by 10% in 2023, falling from very high absolute levels. Road machinery – particularly light compaction equipment – was the major contributor to these declines, as sales of road equipment fell by 21%. The other equipment segments saw stable performances, with earthmoving equipment and concrete equipment both seeing minimal 1% growth in sales. However, sales of tower cranes increased by 16%.

It is important to put the development of the two building construction equipment segments into perspective. Reconstruction activity in Turkey following the devastating earthquake had a huge impact on equipment demand. If the Turkish market is excluded, European sales of concrete equipment and tower cranes did not show growth - but in fact saw declines of 20% and 27%, respectively.

Turkey was the leading regional disparity within Europe, with growth in sales of 42% in 2023. Apart from this, growth was limited to Southern Europe, with the exception of Italy where the remarkable growth story of the last two years came to an end in 2023. All other regions – Nordic markets, CEE, and Western European markets – all saw moderate declines in sales after reaching peak levels in early 2023.

Outside of Europe, growth in the key export markets of North America and the Middle East helped European manu-

facturers to improve their overall business performances significantly in 2023. As a result, many equipment companies were able to report growth in turnover despite a declining European market.

Sales of Earthmoving equipment went up by a minimal 3% in 2023. This began with a strong first quarter (+9%) with many machines being delivered to help clear the supply chain bottlenecks from the year before. Following this, momentum slowed in Q2 and Q3, with single-digit declines in sales. Finally, the last quarter ended up at 13% below Q4 levels in

2022. This slowing momentum alongside low new order intake points towards a difficult first quarter for 2024.

In contrast with 2022, compact equipment (+3%) performed better than the heavy equipment segment (-3%) in 2023. The most significant factor in the compact segment was strong growth in sales of compact wheel loaders (+13%), after this product had lagged behind the sales performances of other compact machines in the recent past. Even stronger growth (but at smaller volume levels) was seen for skid-steer loaders, which recorded a remarkable 25% increase in sales. The strong sales of skid-steer

8 CECE ANNUAL ECONOMIC REPORT March 2024

EQUIPMENT MARKET

EARTHMOVING EQUIPMENT 0 50 100 150 200 250 300 2008 2011 2014 2017 2020 2023 original 12 m rolling avg

Monthly construction equipment sales in Europe (index 2010=100)

loaders could be a late effect of the termination of EU tariffs against US-made equipment. The European fleets of this product –primarily produced in the USA – have been renewed and replaced following the ending of the tariffs. Backhoe loaders saw a 6% increase in sales due to strong sales in Turkey and Russia, with the latter being supplied by Asian rather than European manufacturers. The only compact equipment segment that didn’t see growth in sales in 2023 were mini excavators, which saw a minimal decline of 1% after years of very strong growth.

In the heavy equipment segment, only wheeled excavators (+6%) saw some growth in sales last year. Heavy wheeled loaders (-1%), dozers (-5%), crawler excavators (-6%), ADTs (-13%), motor graders (-23%), and rigid dumpers (-30%) all saw a range of declining sales. From a regional perspective, the top four markets had different experiences. The German market saw further modest growth in sales of 4%, while the UK market went down by 8%. France returned to being the third ranked country in Europe as earthmoving equipment sales grew by 8%, while the Italian market saw a 10% decline in sales.

While CEE and the Balkan markets both saw a 5% increase in sales in 2023, the Benelux (0%) and Austria and Switzerland (-1%) were relatively flat. The Nordic markets saw a 5% decline, the same as Southern Europe. Equipment sales on the Turkish market went up by 27% for the reasons highlighted above.

ROAD EQUIPMENT

As highlighted in the introduction, road machinery was the segment that is primarily responsible for the decline in European construction equipment sales in 2023. Sales deteriorated significantly as the year progressed, beginning with an 8% decline in the first quarter and ending with a 37% decline in sales in Q4. For the full year, sales of road machinery were 21% below 2022 levels. However, this development needs to be put into perspective. Firstly, the recent declines in sales came after seven consecutive years of growth between 2016 and 2022. During that period, sales had increased by 46% cumulatively, and it was expected that the 2022 market levels would not be sustained. Secondly, the downturn seen in 2023 was primarily due to light compaction equipment sales,

compact earthmoving

light compaction

concrete vibration

light equipment

heavy earthmoving

road machinery

concrete machinery

heavy equipment

which had seen the strongest growth in previous years. In contrast, heavy road machinery recorded a further 7% increase in sales. Therefore, the conclusion should be that the roadbuilding segment remains an important and stable part of construction equipment sales in Europe.

From a product perspective, sales of vibratory plates were most affected by the downturn and saw sales decline by 29% in 2023. Declines in sales of vibratory tampers and walk-behind rollers were more moderate, as both products only saw a 12% fall. In the heavy compaction segment, the largest-volume product tandem rollers experienced double-digit

sales growth of 11%. Single-drum rollers maintained the same level of strong sales seen in 2022 (0%). Sales of trench rollers went up by 11% and combi rollers saw a 21% increase in sales last year. PTR sales were also on a positive trend at 13% growth. In contrast, asphalt pavers saw sales decline by a fifth, albeit sales were on an improving trend during the year.

When looking at the market regions, the largest market Germany saw a moderate decline in sales of 8%. This relatively low rate resulted in the share of road equipment sales increasing from 28% to 33% within overall equipment sales in Europe, the highest ever seen. As a result, it seems

9 CECE ANNUAL ECONOMIC REPORT March 2024

-25% -20% -15% -10% -5% 0% 5% 10%

sales development of light and heavy equipment Germany 24% UK 12% France 12% Italy 9% Russia 5% Turkey 4% Poland 4% Netherlands 3% Spain 3% Sweden 3% Others 21% Shares of construction equipment sales in European countries, 2023

2023

likely that the German market will experience another “correction” in 2024. Europe’s number two market France (-32%) and number three market UK (-23%), both saw substantial sales declines last year. Other large-volume markets experienced different levels of declines in 2023. CEE markets went down by 25%, sales in the Nordics fell significantly by 44%, the Benelux market declined by 9%, and Austria and Switzerland saw a 36% fall in sales. Only Southern Europe registered modest growth at 3%, but in this region, the momentum was slowing down during the course of the year.

CONCRETE EQUIPMENT

Sales of concrete machinery on the European market in 2023 were at similar levels to the previous year and showed marginal growth of 1%. Similar to earthmoving and road equipment sales, there was a slowing momentum during the year. After growth of 8% and 2% in Q1 and Q2, respectively, the third quarter showed flat sales before seeing a moderate decline of 6% in Q4. As highlighted previously, sales in 2023 were supported significantly by extraordinary growth on the Turkish market, where sales increased by 80% last year. If Turkey is excluded from the statistics, sales of concrete equipment in Europe showed a 20% decline last year, which is a more realistic reflection of the market situation in 2023.

The German market saw sales increase by 7% in 2023, while the French market declined moderately by 5%. Southern Europe still performed well (+3%) due to the growing Italian market which has become the thirdlargest market in Europe for concrete equipment. Growth on the CEE markets has come to an end, with sales declining by 9% in 2023. Alongside this, the UK market contracted by 18%. The Benelux markets saw a small decline of 4%, and the Russian market went down by 22%. Contrary to the trend in other segments, sales on the Nordic market went up by 3%.

In the light equipment segment, concrete vibration equipment saw a continuation of the declines seen in 2022, with sales falling by 20% last year. Heavy machinery sales were much stronger, but much of this can be attributed to the impact of the Turkish market. Sales of truck-mounted pumps increased by 35%, but this is only 8% if Turkey is excluded. Sales of truck mixers were on a par with 2022 levels while truck mixer pumps (-4%) and mixer systems (-6%) saw moderate declines in sales. Strong declines were also

recorded for sales of batching plants (-20%) and stationary concrete pumps (-41%).

With growth in sales of 16% in Europe in 2023, tower cranes was the strongest performing of the construction equipment sub-sectors. Saddle-jib cranes (+17%) saw stronger growth than the lower-volume segment luffing boom cranes (-23%). However, similar to other segments, sales statistics including Turkey, provide a misleading picture of the market. If Turkey is excluded, sales of tower cranes in Europe were down by 27% in 2023, with the impact most noticeable in the second quarter of the year.

In 2023, Turkey accounted for over a third

of European sales of tower cranes. Beyond this, the two largest markets, France and Germany, saw substantial declines in sales of 47% and 39%, respectively. Southern Europe was the only region that saw growth in sales, reaching 30% for the year. Austria and Switzerland (-32%), Benelux (-34%), UK (-40%), Nordic countries (-59%), and CEE markets (-59%) all saw significant declines. Taking this on board, 2023 was a bad year overall for the tower cranes market in Europe, and the low level of new order intake gives rise to further concern regarding prospects for business in this segment in 2024.

SUMMARY AND OUTLOOK

The modest declines in sales of construction equipment on the European market

10 CECE ANNUAL ECONOMIC REPORT March 2024

-40% -35% -30% -25% -20% -15% -10% -5% 0% 5% 10% 15% 20% Germany UK France Italy CEE Q1 2023 Q2 2023 Q3 2023 Q4 2023 -50% -40% -30% -20% -10% 0% 10% 20% 30% 40% 50% 60% Nordic Benelux Russia Turkey Spain Q1 2023 Q2 2023 Q3 2023 Q4 2023

Construction equipment sales in major European markets compared to previous year in %

TOWER CRANES

Construction equipment sales in major European markets compared to previous year in

%

in 2023 are in line with what was expected a year ago. However, it would be misleading to describe the outcome for sales last year as a soft landing. In particular, the second half of the year saw a significant decline in sales, and further to this, new order intake is remaining weak and causing concern. There is a very mixed pattern across the sub-segments, with equipment manufacturers who supply the building construction sector being reminded of the crash in 2008, even if there is wide consensus that the levels of sales declines won’t be as bad as during that period.

Alongside a tough economic environment, the business climate amongst European construction equipment producers deteriorated during 2023 and is deep into the negative area at the start of 2024. There seems to have been a slight bounce-back for future expectations in January and February, but caution is required to not over-interpret these developments. None of the European market regions is currently being assessed positively by CECE member companies. Nordic markets are currently registering the gloomiest outlook, but markets like Germany, the UK, Benelux, and CEE are not being assessed much better.

As a general observation, it is encouraging that cancellation of orders is not significant within Europe. In addition, levels of inventory have increased, but are not at extraordinarily high levels. As machine delivery times are no longer an issue, the ordering behaviour of enduse customers has returned to a much more short-term pattern. This suggests that current low order volumes may only be temporary, and the situation should pick-up during the

course of the year. Also, the civil engineering sector should continue to support equipment demand during the year, as infrastructure projects – road and rail, airports, broadband network development, investments in energy infrastructure – are continuing in Europe.

In this difficult market situation, the overall financial prospects for European equipment manufacturers will be dependent on whether opportunities in global export markets can continue to compensate for the shortfalls on the home market in Europe. North America remains the most dynamic market and is by far the most important export destination for European equipment. However, this market is showing signs of being saturated and as a result, it must be assumed that the potential for additional growth is limited.

The Middle East was one of the growth markets in 2023 but is experiencing significant geopolitical threats, and as a result, the future looks uncertain. The emerging construction equipment market in India should continue to grow in 2024 despite the General Elections this year, which typically slow down the economy for some months.

However, the Indian market is primarily supplied by domestic equipment producers – some of which are owned by European companies – and, as a result, is not the best export opportunity. Latin

However, overall, the positive factors supporting growth in equipment sales will not be able to offset the negative ones. In particular, this is due to the continued weakness within the residential sector, high interest rates, and geopolitical threats, all impacting significantly on equipment demand. As a result, a double-digit sales decline is a realistic scenario for the European market in 2024. It is expected that the decline in building construction equipment sales will be more significant than earthmoving and road construction equipment.

America could see a return to growth this year, after a very difficult 2023, but this market is not big enough to make a significant difference on a global scale.

Finally, there are very few signs of a substantial recovery in China after two disastrous years. While European manufacturers don’t have much to lose on the Chinese market, the ever-growing competitive pressure from Chinese manufacturers in third country markets will certainly present one of the most significant challenges in 2024.

11 CECE ANNUAL ECONOMIC REPORT March 2024

Product groups: construction equipment sales in Europe compared to previous year in %

-40% -30% -20% -10% 0% 10% 20% 30% 40% 50% Earthmoving equipment Road equipment Concrete equipment Tower cranes Hydraulic attachments Q1 2023 Q2 2023 Q3 2023 Q4 2023 -100 -80 -60 -40 -20 0 20 40 60 80 100 Feb-19 Feb-20 Feb-21 Feb-22 Feb-23 Feb-24 Business Index Current Business Stuation Future Expectations European business climate

CECE Barometer February 2024

index,

European landscape industryinterview with Egbert Roozen, ELCA Secretary General

CECE: What is your role and your main responsibilities in ELCA? Which industry does ELCA represent and what is its mission?

Egbert Roozen: I am secretary general of the European Landscape Contractors Association (ELCA). Prior to this position I was 13 years director of Royal VHG, the Dutch association of landscapers and gardeners. ELCA counts 23 national member countries and three associate members (Canada, Japan and United Kingdom). Our office is located in Brussels where I, amongst others, represent our sector at the European institutions. Political lobby is my main task on topics that concern the link of greenery and nature-based solutions to climate, biodiversity and public

health. On these themes ELCA performs a proactive agenda on European and global level.

CECE: How would you describe the current market situation for landscaping businesses in Europe? Are there significant trends of challenges expected?

Egbert Roozen: Although we don’t collect economic figures yet, our market is developing in a positive way. In some countries the market of private gardens follows the developments in the construction sector. The market for public green grows in general. This positive development is enhanced by more and more attention to damage caused by climate change, the loss of biodiversity and the need of people to live in a healthy and safe environment. We see these aspects now at the table in the policy, design and planning process. This means also an other position of the landscaper and gardener. Not any more at the end of the supply chain and not any more with green solutions that were seen as only a cost.

CECE: How do the main market drivers in the landscaping sector contribute in the overall economy and job creation across Europe?

Egbert Roozen: The majority of the companies in our sector are small (1 to 5 employees) and active on a local and regional market. The bigger companies have a more regional and national market focus. Working across the borders is something that is done by only a very few companies. Job creation is from this point of view mainly dealt with on national level.

CECE: How does technology influence the landscaping sector? Are there specific advancements that ELCA considers transformative or beneficial for its members?

Egbert Roozen: We are now in full transition to electric or battery equipment and machines. That also links to the wishes of the clients. GPS, apps and virtual reality also become more and more common in our work. I consider this development very important in the pathway to become sustainable on different aspects. Not only related to the use of machinery, but also to transport and human resources.

CECE: What initiatives or practices has ELCA implemented to promote environmental sustainability within the landscaping sector? What specific measures do landscaping companies take to minimize their environmental impact?

Egbert Roozen: We have already done different actions to realize this, but the latest is about the translation of the sustainable development goals (sdg’s) of the United Nations to company level. We are now designing a toolbox that helps companies to define their on pathway to a sustainable level. So far we see, that companies do already a lot such as electrifying their working equipment and transport, energy saving in their own building and the way they take care for their workforce.

CECE: What are the key challenges currently faced by the sector in Europe?

Egbert Roozen: Our workforce is our absolute number one challenge. Especially when you look at the development that we make as a sector to answer societal challenges on climate, biodiversity and public health with our green solutions. We need more new influx of people who want to work in our green sector and we must maintain a good job- and career perspective for our employees. For that, amongst others, vocational training and life long learning must be up to date.

12 CECE ANNUAL ECONOMIC REPORT March 2024 SNAPSHOT

CECE: Looking forward, what is the outlook for the landscaping sector in Europe and are there emerging opportunities that ELCA is monitoring?

Egbert Roozen: We are very positive about the future of our sector and see great opportunities for the markets of private gardens, public green and green infrastructures in the public domain, green roofs, green facades and indoor greening. European policies, as defined in the European Green Deal, support the development of green innovations and solutions. I monitor these policies and seek for proactive partnerships on behalf of ELCA.

CECE: Considering the upcoming Nature Restoration Law, how does ELCA perceive its potential impact on landscaping contrac-

Does ELCA have any specific recommendations or strategies for its members to leverage opportunities presented by this legislation?

Egbert Roozen: We are very enthusiastic about this new law regarding the specific regulations for the urban area. For the first time in history, greenery in the city is put into law. Based on national and local restoration plans, there will be a clear perspective on the green development in urban areas to lower the impact of climate change, to enhance biodiversity and make the city a nice and sustainable place to live. Our aim is to make sure that landscapers and gardeners are involved in the definition and implementation of these restoration plans so that we create the green solutions that really benefit us all.

13 CECE ANNUAL ECONOMIC REPORT March 2024

EUROPEAN MARKETS

National perspectives by CECE members

The national CECE member associations shed more light on regional developments in the European construction equipment sector, describing main drivers of growth and forecasting the year 2024.

Country How did the market develop in 2023?

Belgium Earthmoving and construction equipment

- Invoiced sales (delivered equipment): a stable situation overall with sometimes huge differences between types of equipment.

- Order intake decreased from 15% to 25%.

What were the main drivers?

Earthmoving and construction equipment

- Belgian companies are still benefitting from massive order intake in previous years. Decreasing orders are being compensated by deliveries of older orders flattening the decrease.

- After booming years, supposed to calm down, Federal and Flemisch governments made massive capital injections in major infrastructure projects (i.e. Oosterweel project, in the Port of Antwerp) during Covid lockdown, taking order bookings to unprecedented levels.

- Lower levels of order intakes are a consequence of customers’ waitand-see attitude due to an uncertain macro economical and international political situation.

What is the forecast for 2024?

Earthmoving and construction equipment

- Although order intake will decrease, major customers expect business recovery at the end of 2024, beginning of 2025.

Source : Sigma (Equipment Representatives for Public and Private Works, Building and Handling).

Czech Republic - Good improvement in Road construction, as rules were finally officially set on how to proceed in planning / building of strategic infrastructure.

- Highways investment increased compared with earlier years. Both planning and execution of projects.

- Rebuilding the main railway corridors in order to achieve transport optimisation.

- Overall slowdown of the economy due to financing costs.

- Stronger 1st half of 2023 due to order backlog from the previous year. Significant decline of production in 2nd half of year, resulting in low order backlog at the beginning of 2024.

- Supply chain production downstream is full with a high stock of machines - resulting in lower order intake in 2nd half of 2023.

- Infrastructure deals.

- Housing projects.

- Positive growth developments in the EU (mainly Germany) is an essential condition for recovery.

- Inflation rate needs to settle within the 3-5% range.

- CNB - central bank to soften monetary policies and ease access to loans to boost the economy.

- A low unemployment rate is still indicating a significant need for machinery in the market.

- A decline in production volumes due to overall market expectations for 2024. The factors needed to revitalize the economy will take a long time and result in a slow ramp-up.

14 CECE ANNUAL ECONOMIC REPORT March 2024

Country How did the market develop in 2023?

What were the main drivers?

What is the forecast for 2024?

Finland - Construction of new housing went down by a staggering 38%.

- All construction (housing, infrastructure, repair and maintenance) decreased by 10%.

- Rental of construction equipment went down by 9%.

- Export of construction equipment increased by 3%. Imports decreased by 10%.

France - Relative stabilization of Construction equipment sales:

-0.3%.

- Earthmoving equipment sales: +2%.

- [-5.9% for Heavy Equipment and +4.3% Compact Equipment].

- Very high level of orders at the beginning of 2023.

- Order intake gradually decreased during the year and saw a gradual return to more normal delivery times.

Germany - Earthmoving equipment sales grew by another 1.2% to reach the highest ever historical levels.

- Road equipment sales went down by 8%.

- Building construction equipment was uneven (growth in concrete equipment sales, strong declines for tower cranes).

Italy - Construction equipment sales increased by 13.6%.

- Significant growth in market demand in 2023.

- Strong growth in: Waste management, Rental, Govt.

- Flat levels in: Agriculture, Material handling, Mining, Forestry.

- Weak growth in: Construction,

- Construction Equipment sales increased compared with 2022.

- A slight downturn in sales of Earthmoving equipment (-4%). However, a great performance from rigid dumpers.

- High price levels, high interest rates, slow economic growth and oversupply of housing and business premises slowed construction down.

- Population growth in larger cities will increase demand for housing.

- Finnish GDP estimated at 0…-1% in 2024.

- A lot of sales from orders taken previously.

- A deteriorating economic climate and a lot of uncertainty amongst customers.

- A slowdown in the 4th quarter, particularly for investments by rental companies

- A decline in construction activity

- 6% decrease in the Building sector.

- 4% increase in the Civil Engineering market compared with 2022.

- Local authorities are slow to increase their investments.

- Residential construction is the biggest concern (new residential construction output is forecast to drop by 15% in 2024).

- On-going civil engineering projects are supporting equipment demand.

- Awarding of new projects is being delayed by excessive bureaucracy.

- The National Recovery and Resilience Plan (PNRR):

- Investment in machines to support the Transition 5.0 plan

- Reinforcement of public works (instead of residential construction).

- The purchasing indicators suggest that there is still an appetite from customers in the Netherlands to purchase machines, which resulted in growth in 2023.

- Strong demand for Zero Emissions machines in future.

In 2023:

- The main drivers were renovation and civil works.

- Slight decrease in the residential and non-residential sectors.

- Construction of new housing is at alltime low at the start of 2024, expected to stay at -15…-20% in 2024.

- Interest rates are expected to go down and demand for housing will increase at the end of 2024.

- Construction of business premises will increase.

- Level of repair and maintenance activity will remain unchanged.

- Rental of construction equipment will go down by 1%.

- A 12% decline forecast for 2024.

- A drop in sales for machines for quarries, the building sector and rental companies.

- Still optimistic regarding sales to contractors (public works) and, to a lesser extent, to Local Authorities.

- Low order backlog and lack of new orders suggest a very weak first half of the year.

- Sales on the German market are expected to decline by up to 10%

- Industry turnover from German production will also decline by double-digit levels.

- Italian construction equipment sales are expected to decline by approx. 4%.

- The Construction sector is expected to decline by 2.5% this year before sales bottom-out in 2025-2026.

- Macro-economic factors are not favorable.

- Clean & Emission free construction equipment is to be used in projects to control nitrogen emissions. As a result, less projects are being sanctioned.

- Expected growth of 1.4% in the civil engineering and renovation market.

- Residential sector expected to increase slightly in 2024. However, demand remains high.

- An increase in the rental market.

15 CECE ANNUAL ECONOMIC REPORT

Country How did the market develop in 2023?

- Sales of compact equipment increased by 43%.

- Compaction sales remained stable.

- Lifting equipment has increased by 13% (consisting of telescopic handlers).

- The Construction sector increased by 2.8%.

Sweden - Stable but declining market.

- Infra-structure still strong.

•- Building is weaker.

- Back logs built up during the pandemic years are declining.

- New orders coming in.

UK

- Sales of construction and earthmoving equipment declined by just under 9% in 2023.

- It was very much a “year of two halves”. Sales were 8% above 2022 levels in the first half of the year, but then declined by 25% in the second half of the year compared with the previous year.

- Despite the decline, sales in 2023 were still at relatively high levels. Equipment sales in the two previous years were at the highest levels since the “financial crash” in 2008.

What were the main drivers?

For 2024:

- Commissioning of public construction projects - Infrastructure, roads, ports. However, there is uncertainty regarding new norms, bidding processes, material costs, logistics etc.

- Expected increase in building licenses.

- Shortage of qualified workers and professionals.

- Public investment in infrastructure projects is growing. Sweden has an enormous infra-structure (investment) debt. New and maintenance.

- Recycling and waste industry drives investments.

- Also Manufacturing industry to some extent.

- An Industrial boom in northern Sweden.

- Other investments are heavily impacted by high interest rates. In particular - private building projects.

- Equipment sales in the early months of 2023 benefitted from the “catch up” impact of supply chain constraints in 2022, which extended lead times for delivery of machines. In contrast, equipment sales in the second half of the year experienced the impact of declining levels of construction activity, particularly in the housebuilding market.

- The private housebuilding sector experienced double digit declines in activity in 2023 and was the weakest sector within the construction market. However, the infrastructure sector provided some stability, supported by work on major projects such as HS2, the Thames Tideway Tunnel and Hinkley Point C.

What is the forecast for 2024?

- Continued overall decline due to a declining back log and new orders coming in at slower rates.

- Many investments are on hold because of the recession and high interest rates.

- A change in the business climate and reduced interest rates could have a positive impact in the second half of 2024.

- Construction output is forecast to decline by 2.1% in 2024. Private housing is expected to fall by a further 4%, with high interest rates remaining a factor. Activity in the infrastructure sector is forecast to decline by 0.5% this year.

- Sales of equipment in 2024 could decline by up to 10%. Sales in the first half of 2023 were exceptionally high and demand for equipment this year looks set to suffer from lower housebuilding activity and reduced requirements from infrastructure projects.

16 CECE ANNUAL ECONOMIC REPORT March 2024

CONT RIBU TORS

Take a moment to acquiant yourself with the dedicated members of our CECE reporting team. The individuals listed here have actively contributed to shaping and curating the content within this publication. Their collective efforts aim to provide you with insightful and comprehensive coverage of various aspects within the industry.

Roma keeps the publication in order by managing deadlines and laying out the publication into a publishable version, once all chapters have been drafted. In addition, together with Riccardo, she coordinates the production of the report’s animated movie.

Sebastian contributes to the publication by providing the text for the Equipment Market chapter, covering tower cranes, earthmoving, road and concrete equipment. Sebastian is also involved in the drafting phase of the script of the report’s animated movie.

Paul, apart from being one of the contributors of the report by drafting the Global Mining Industry chapter, is also responsible for the proof-reading of the entire text. Being a native English speaker, this task was entrusted to him. Thanks to Paul no linguistic bloopers sneak into our report.

Eleonora, together with Corrado, collaborates on creating the Snapshots. This chapter is adjusted annually to address industry-specific themes that are timely and significant - spanning from trade fairs and major investments, to CECE Economic Forum session during the Summit and the Congress.

Corrado contributes to the report by drafting the Snapshots. These chapters change from year to year, in order to cover the most relevant topics for the industry at a given moment in time. The topics range from areas like exhibitions and trade fairs, to major investments and CECE Economic Forums.

Rudolph is responsible for drafting the Macroeconomic View which provides insights into the economy of the euro zone. He also contributes to the publication by drafting the Construction Industry chapter, covering the construction sector by country.

Riccardo is the head of the organisation, and oversees the whole publication. He is also involved in providing input into the report by writing the opening statement and drafting the rental industry chapter. In addition, together with Roma, he coordinates the production of the report’s animated movie.

17 CECE ANNUAL ECONOMIC REPORT March 2024 CECE REPORTING TEAM

RICCARDO VIAGGI Secretary General, CECE

RUDOLPH GANZEL Director of Economic Affairs, EVOLIS

PAUL LYONS Market Information Manager, CEA

SEBASTIAN POPP Deputy Managing Director, VDMA

CORRADO SERRENTINO Communication & Public Affairs Manager, UNACEA

ELEONORA BODO Office Manager, UNACEA

ROMA GUZIAK Senior Communications Manager, CECE

What is the Committee for European Construction equipment?

CECE represents the European construction equipment industry towards the European Institutions, coordinating the views of its national member associations, and working with other organizations worldwide to achieve a fair competitive environment via harmonized standards and regulations.

The sector counts around 1200 companies. Its durable and innovative machinery are working tools to help to build the houses, offices, factories, roads, railways and bridges that serve citizens across the globe. Manufacturers invest and innovate continuously to deliver equipment with highest productivity and lowest environmental impact. Efficiency, safety and high-precision technologies are key.

WHAT WE DO

CECE is the acknowledged partner of the institutions of the European Union for all questions related to the construction equipment industry. Based in Brussels, CECE’s work involves political representation and the monitoring of legislation and standardization on behalf of its member associations and their corporate members.

CECE also cooperates with CEN and ISO, the European and International Committees for Standardization. CECE furthermore delivers and economic and statistical services to its members and partners.

Representing the interests of the industry

New buildings and infrastructures connect people, boost economies and serve people all over the globe. Construction equipment manufacturers are highly innovative and have invested heavily in increasing the productivity of their machines, while reducing their environmental impact.

The European construction equipment industry forms an important, integral part of the European machinery sector. Manufacturers are predominantly small and medium-sized companies but also large European and multinational companies with production sites in Europe. The industry employs directly and indirectly up to 300,000 people.

Statistics and economic topics

CECE collects a and provides up-to-date market data for many types of construction equipment, providing a leading indicator for the development of European construction equipment markets.

Since 2008 CECE runs a monthly business trend enquiry, the CECE Barometer. The companies taking part in the Barometer receive a report about the economic situation in Europe each month.

Exhibitions

CECE gives patronage to a limited number of leading sector exhibitions, contributing to successful trade fairs around the globe.

BluePoint Building, Bd. Auguste Reyers 80, 1030 Brussels

Phone: +32 2 706 82 26

E-mail: info@cece.eu

website www.cece.eu

Follow CECE also on:

18 CECE ANNUAL ECONOMIC REPORT March 2024

BluePoint

Riccardo Viaggi CECE Secretary General

Riccardo Viaggi CECE Secretary General