COVID-19 Flash Survey: Lack of future demand more troubling than current production disruptions

Periodic updates of the CECE flash survey on COVID-19 are being used by CECE to keep the industry and stakeholders informed of the impact the crisis is having on manufacturers of construction machinery.

This new April survey paints a very worrying picture for the European CE Industry facing the consequences of the COVID-19 outbreak. The ad-hoc flash survey ran between 22nd and 27th April and gathered input from a representative group of industry leaders assessing the impact and delivering their perception on the business perspective.

With over 60% of respondents pointing to significant reduction and 15% reporting factory closures, it is evident that the impact on production is already severe. No single company reports not being affected at all. This is clearly worse than our first COVID-19 flash survey we ran at the end of March.

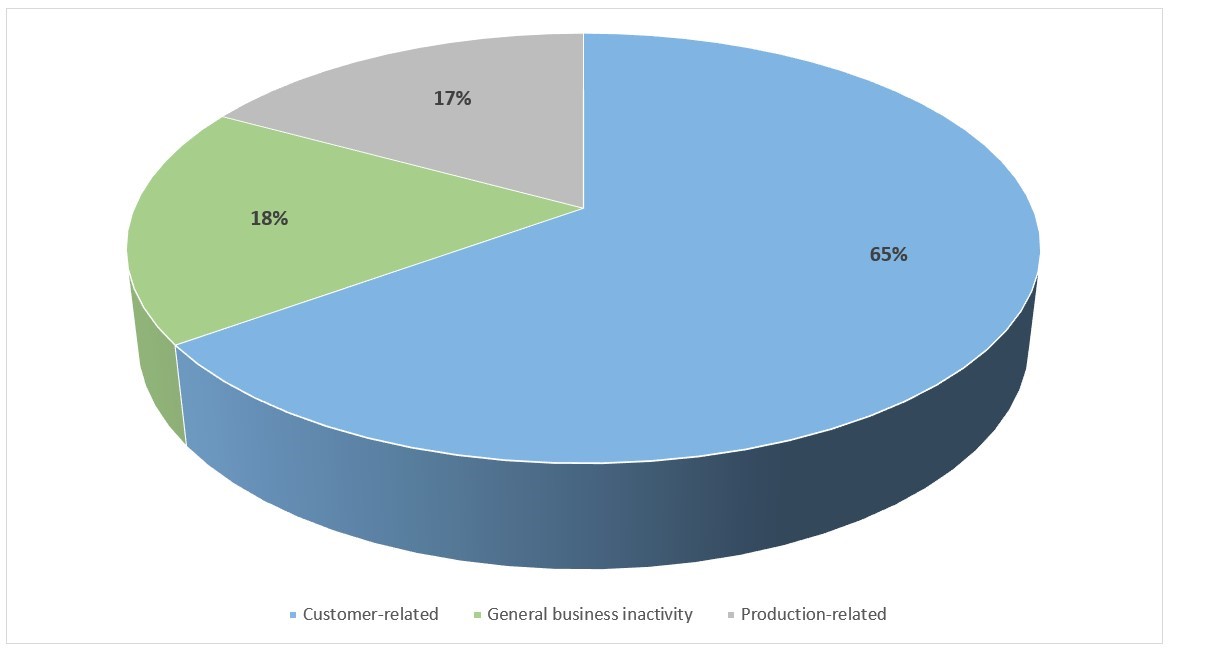

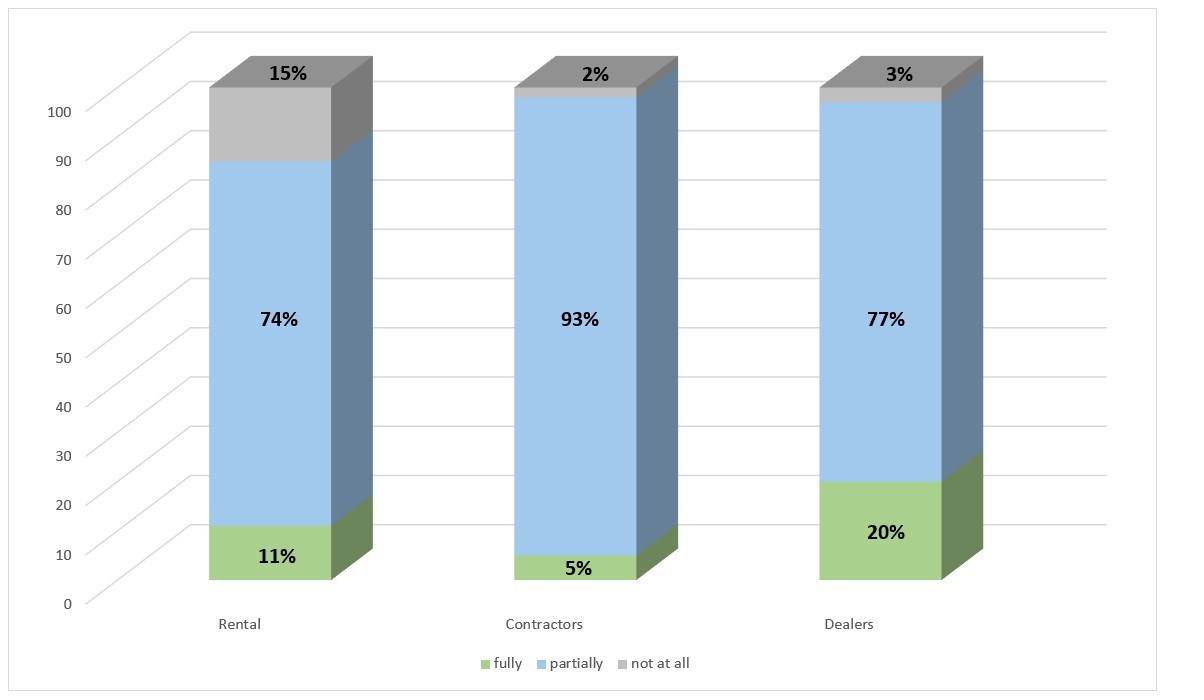

Responses to the second question confirm the single most important concern by OEMs relates to the behaviour of customers. Indeed, 65% of respondents are worried by prolonged construction inactivity and failing demand even after the health emergency will be over. With regards to customers’ behaviours, CECE also tried to measure the activity levels of the main relevant groups: the quasi-totality of OEMs’ customers are only partially operational.

Ranging from 74% for rental companies to 93% for contractors, it is evident that all customer groups are operating at a partial rate. It is interesting to note that 15% of the respondents report rental companies to be fully unavailable and non-operational.

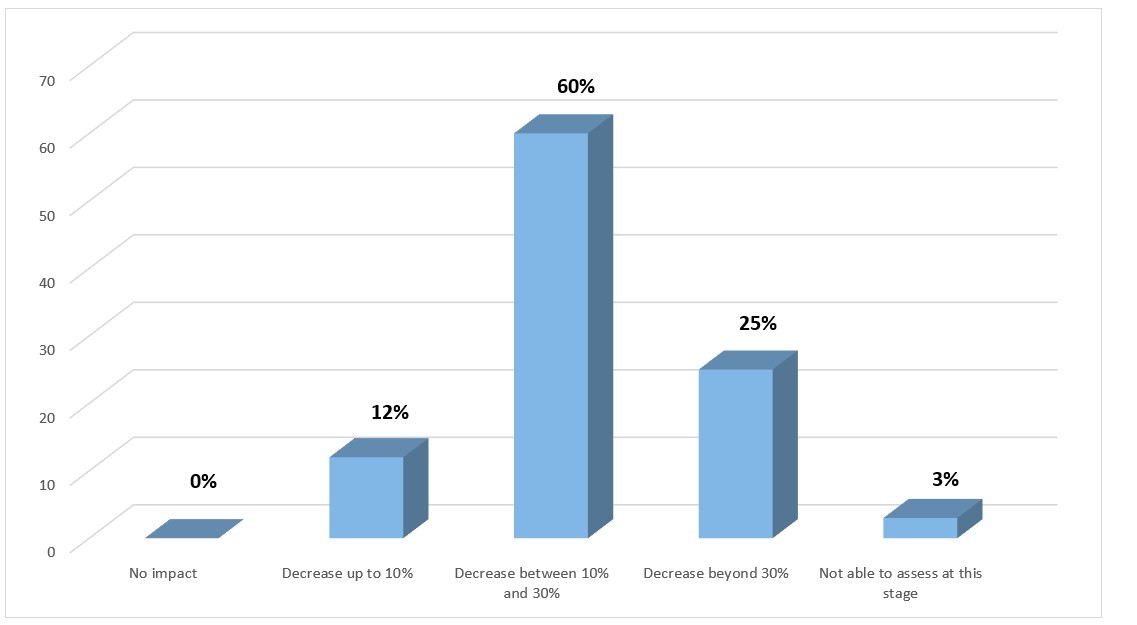

The CECE flash survey also tried to gauge the impact of this crisis on OEMs’ sales expectations.

The uncertainties surrounding this question in last month’s CECE flash survey seem to have dissipated, with only 3% - down from 15% - of the respondents saying it is currently impossible to estimate the commercial impacts. There is a clear increase of respondents - 60% instead of 40% - that point to an estimated drop in sales between 10 & 30% and a comparable share of 25% of the respondents foresee an even more severe drop of over 30%.

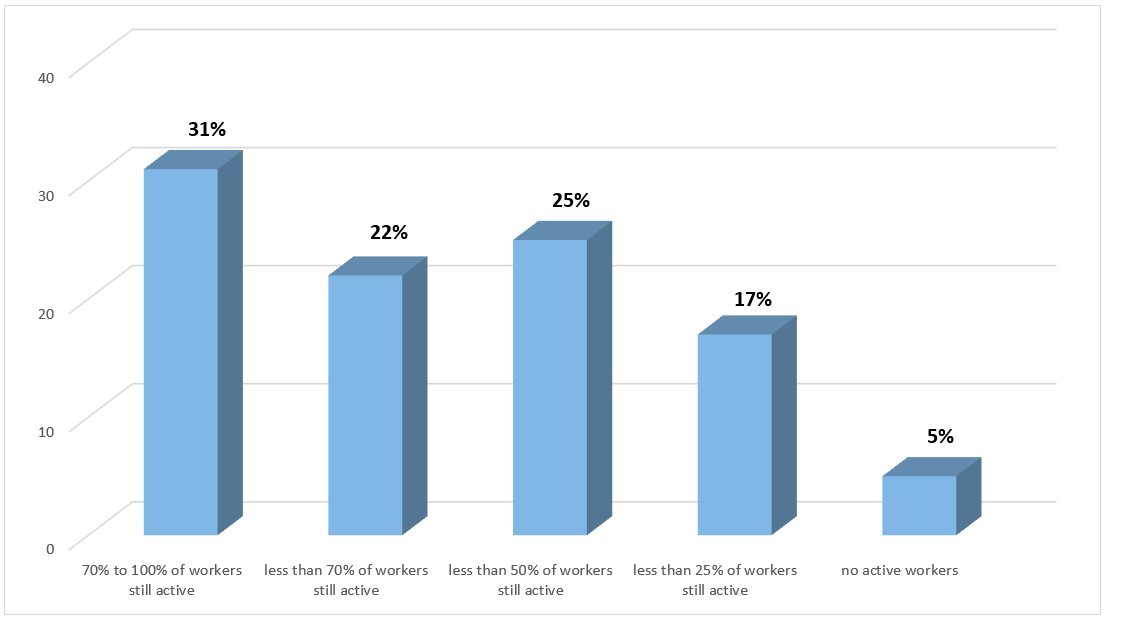

This month’s survey also included new questions about the levels of employment. Albeit a surprising 31% of factories in the survey are reported working at over 70% employment activity, close to half of the respondents are working at 50% of the manpower or less, including 5% of the companies with no active workers. Two thirds of the inactive workforce is supported by temporary layoff support measures.

In all categories of the CECE flash survey on COVID-19, there is an evident deterioration of the situation compared to last months and the current focus on market demands is a powerful warning sign that the worst is yet to come for the industry.

Additionally to this survey, CECE develops the Business Climate Index – BCI – a measure of industry sentiment across a group of leading industry figures. The BCI in April reached a staggering -80 points on the basis value of 0 and coming from a +40 value in March. It seems evident that, as the COVID-19 crisis fully unfolded across Europe, CECE’s Barometer index recorded its strongest monthly decline in history and hit its lowest level ever. Please see here the graph of the CECE BCI.

Within or in addition to the monthly Business Barometer, CECE will keep carrying out regular members’ surveys in this particular time. If you want to take part in these surveys, please write to info@cece.eu.

Want to know what CECE is doing to try and limit some unneeded negative consequences of this crisis, read here about CECE’s request to postpone application of the transition deadlines within the EU Stage V Regulation.